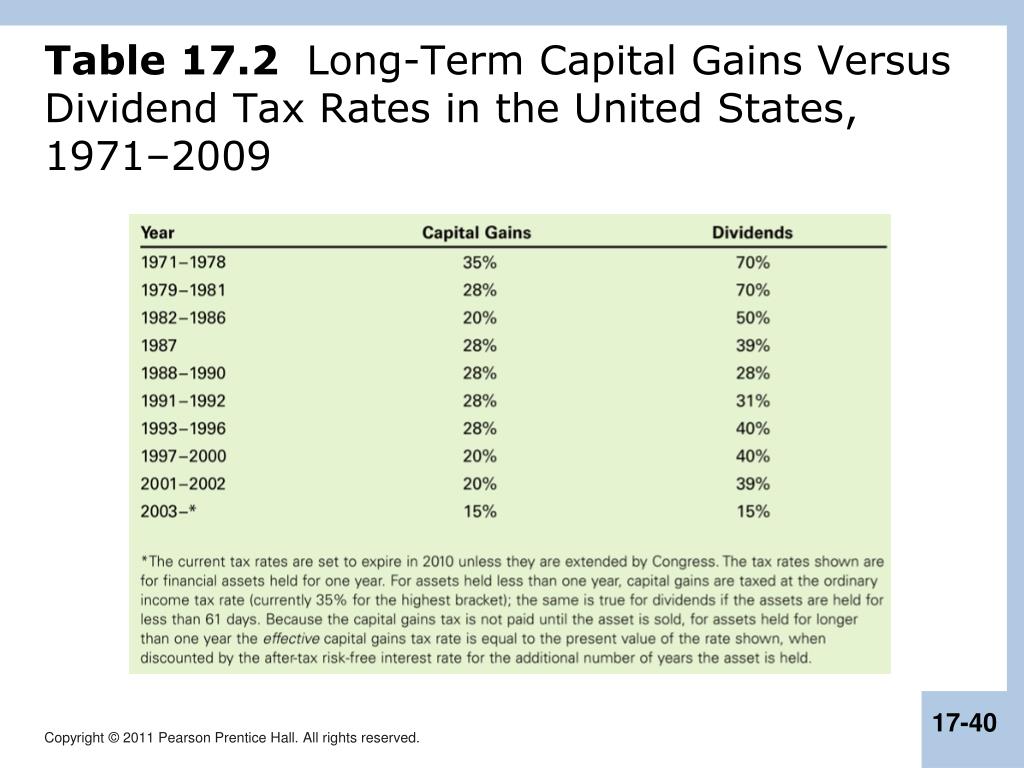

Capital Gain Tax Vs Dividend Tax. Use this guide to know the basics. apr 8, 2021the tax rates on capital gains and dividends depend on how long you hold an investment, your taxable income and filing status. by arthur dubois | july 26, 2023 | dividend, investing the dividend tax rate in canada is something that benefits the average canadian investor. Hence, the net capital gain is rs 63, 00,000. On the other hand, dividends are assets paid out of the profits of a corporation to.

For a net capital gain of rs. By and large, capital gains carry a lower tax rate than regular income. On the other hand, dividends are assets paid out of the profits of a corporation to. Capital Gain Tax Vs Dividend Tax how capital gains are taxed varies from country to country. One key difference between dividends and capital gains is that dividends are taxed, while capital gains are not. jun 30, 2017the tax rate on eligible dividends varies across the country from about 25% to about 43%.

PPT M170 Corporate Finance Handout 3 PowerPoint Presentation, free

One key difference between dividends and capital gains is that dividends are taxed, while capital gains are not. jan 12, 2023how capital gains and dividends are taxed differently by daniel kurt updated january 12, 2023 reviewed by somer anderson fact checked by kirsten rohrs. oct 20, 2020the preferential tax rates for capital gains and dividends are determined by level of taxable income. Most states tax capital gains as ordinary income. On the other hand, dividends are assets paid out of the profits of a corporation to. For a net capital gain of rs. One key difference between dividends and capital gains is that dividends are taxed, while capital gains are not. Capital Gain Tax Vs Dividend Tax.